How We Create Value

Fostering Mutually Rewarding Relationships

Social and Relationship Capital

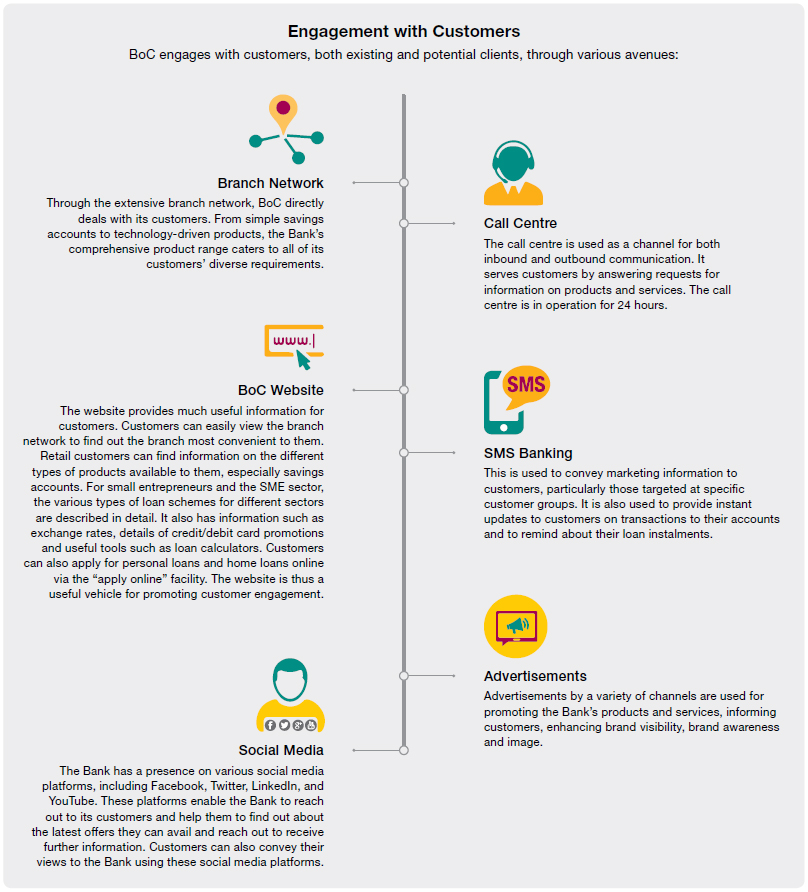

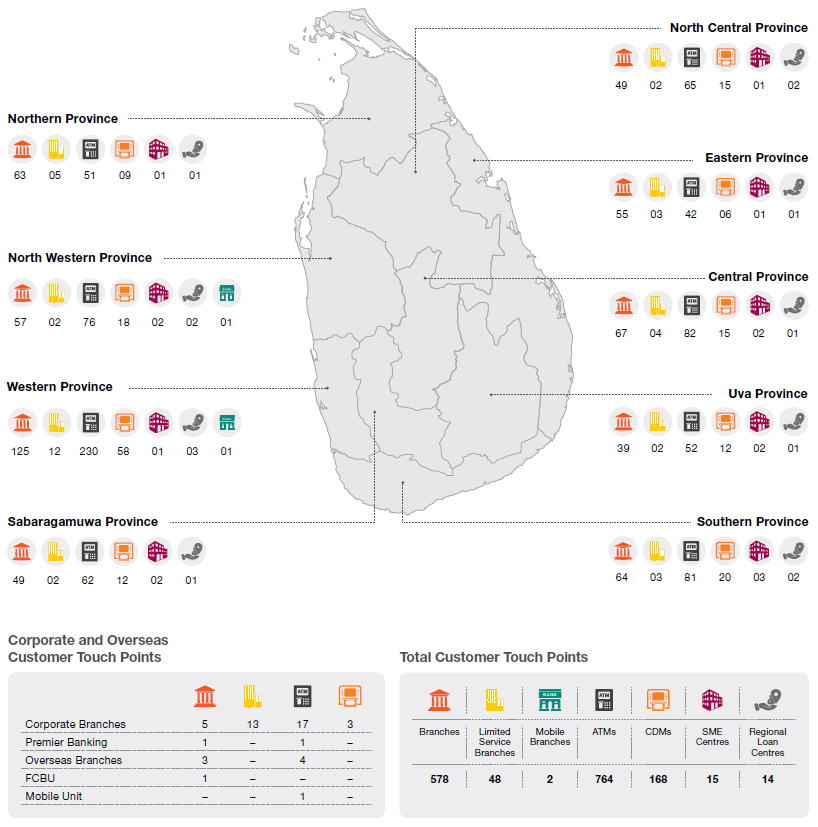

The Sri Lankan banking industry is more competitive than it has ever been, and factors such as customer service and convenience are distinguishing features that customers look for. With a strong network of 575 branches and 48 limited service branches across the island, BoC maintains a strength in geographic reach that few can match.

Stakeholders

The stakeholders of the Bank include the Government, employees, customers, investors, regulators, suppliers and also the society in which it operates as a whole. Customers of the Bank comprised two main categories; depositors and borrowers.

The Sri Lankan banking industry is more competitive than it has ever been, and factors such as customer service and convenience are distinguishing features that customers look for. With a strong network of 575 branches 48 limited service branches across the island, BoC maintains a strength in geographic reach that few can match. In addition, two mobile branches were introduced during the year, 41 branches were upgraded to serve customers more efficiently, and 86 ATMs and 45 CDMs were installed. As the Bankers to the Nation, we have always been in the forefront of giving the best to our people irrespective of their social standing. We have always taken lead steps in taking the technology from the towns to the periphery. An example has been the introduction of ATMs and especially CDMs; our efforts to not limit the technology to a few but take it to the many have been quite successful. This demonstrates the changing profiles of customers even at the grass roots and their demand for improved and next level financial services.

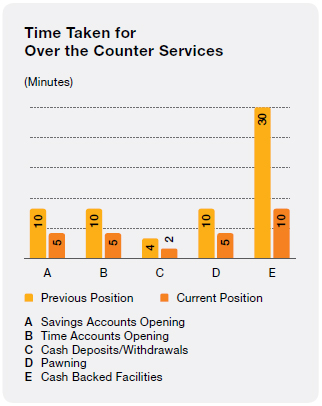

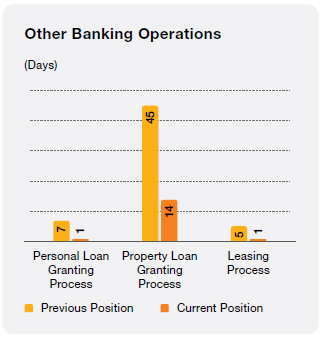

The Bank converted all its branches to a 5S environment by the end of 2017. The pillars of the 5S environment – Sort, Set, Shine, Standardise, Sustain – represent a means of better organising and managing workspaces while cutting down on wastage. The successful implementation will help to ensure that customers benefit from significant process improvements and short lead times on general banking services such as account openings and processing loan applications.

The ultimate goal for the Bank is to build and maintain mutually rewarding, long-term, sustainable relationships with its customers, based on trust and confidence.

Our Footprint

Areas of Operations

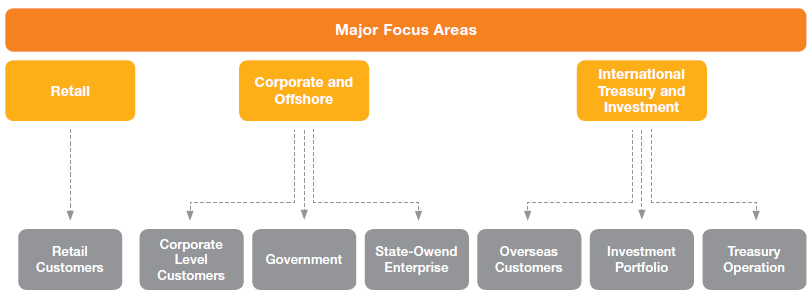

The Bank has three main core areas of operation: retail banking, corporate and offshore banking, and international, treasury and investment.

Retail Banking

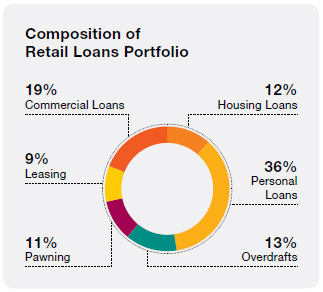

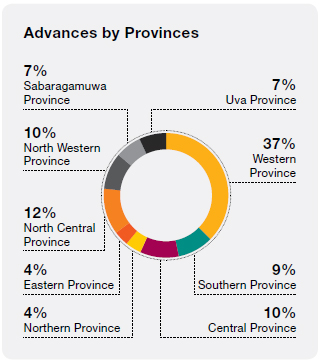

The Bank is traditionally recognised for retail banking and covers a broad spectrum of customer base, ranging from small start ups to corporates and the people resident in rural towns to high networth customers. Products offered under this segment include savings products, time deposits, current accounts, personal loans, housing loans, commercial loans, development loans, micro credit, pawning, leasing, and credit cards. Retail segment offers products matched to folks from all walks of life. We have dedicated savings products for youth, women, children and senior citizens. We also offer special interest rates for these savings products, considering the vulnerabilities of these groups for avenues for satisfactory income. With 40% of the loan portfolio comprising retail banking, this core area is of strategic importance to BoC. Contribution of the retail segment to the profit before tax of the Bank is 55%.

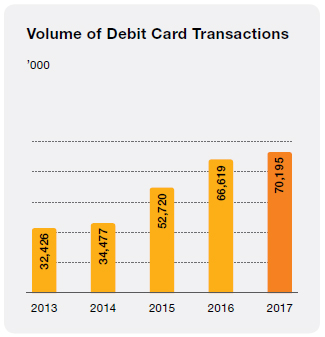

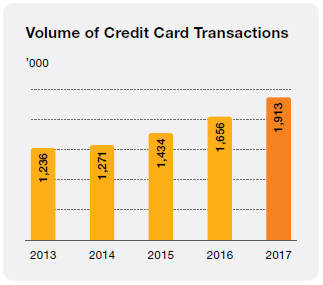

Credit Cards/ATM Cards

The Bank of Ceylon credit card is accepted at more than 6,000 outlets in Sri Lanka and 20 million merchants worldwide. The same applies to our debit card which has a dual functionality as an ATM card, and ensures prudent spending. A total of 15,684 credit cards and 883,939 debit cards were issued in 2017. During the year, the increase in total number of credit cards and debit cards were 12% and 18% respectively.

Strategic Priorities During the Year

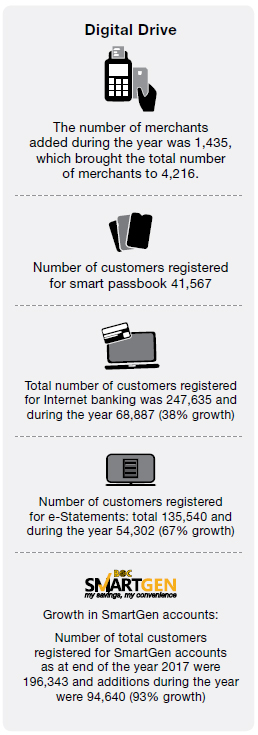

BoC focused on improving customer service and empowering them with convenience aimed at making their banking experience hassle-free. With this in mind, digital banking received significant focus. At the end of 2017, there were 290,221 customers registered for SMS alerts facility for deposits and withdrawals; the service sends out 5,000 alerts on average per day only in ATM transactions. The 168 CDMs across the island received an average of 27,047 hits per day, with LKR 265 billion worth of transactions processed during the year. Out of the 135,540 customers subscribed to e-Statements 40% had subscribed in 2017. Further, during the year, customer complaint handing policy was further strengthened and a customer experienced management unit was also formed to handle all the customer complaints centrally.

Going forward, the Bank’s corporate plan will place more emphasis on service care, customer tangibility, technology and cyber security with an eye towards millennial customers.

Following business processes were automated and implemented in all branches:

- Personal loan orientation, home loan orientation, business loan orientation, CASA opening, standing order processing and complaint handling and customer correspondence.

- With the focus on digital banking, 2017 saw a significant number of customers sign up for e-Banking services. This was one of the initiatives the Bank pursued as part of its focus on “green banking”.

Fostering Financial Inclusion

SMEs are considered to make-up the backbone of an economy. BoC’s SME portfolio reported an outstanding value of LKR 60 billion across the island at the end of 2017. We have a diverse SME products portfolio catering to a variety of economic sectors and needs. Our loan schemes cater to agriculture, dairy farming, fisheries, and plantation crops. There are also loan schemes for renewable energy. The microfinance schemes give a helping hand to small scale entrepreneurs in the grass roots to start enterprises. In addition, we provide loan facilities for the micro and SME sector for working capital and purchase of equipment. Special schemes for the Northern and the Eastern Provinces have been crafted for resumption of economic activities in these areas.

The Bank fosters financial inclusion through its savings account schemes and SME/Microenterprise schemes. It is a part of our social responsibility to promote financial inclusion and literacy.

Summary of “Mithuru” Societies registered during the year:

| Province | Branch | No. of Mithuru Societies Registered | ||

| Eastern Province | Mollipothana | 1 | ||

| Kaluwanchikudy | 1 | |||

| Chenkalady | 1 | |||

| Subtotal | 3 | |||

| North Central Province | Nochchiyagama | 1 | ||

| Bakamoona | 1 | |||

| Subtotal | 2 | |||

| Northern Province | Kankasanthurai | 1 | ||

| Subtotal | 1 | |||

| Uva Province | Lunuwaththa | 3 | ||

| Uva Paranagama | 1 | |||

| Subtotal | 4 | |||

| Grand Total | 10 |

Mithuru microfinance programme is conducted via bank funds. During the year the Bank has disbursed LKR 237.2 million funds for this programme and 277 Mithuru groups and 10 Mithuru societies were formed. The Bank also helped the entrepreneurs developed via Mithuru societies to sell their products through Mithuru pola arranged by the Bank. As at end of 31 December 2017 there were 18,250 registered Mithuru groups and 444 registered Mithuru societies.

The following are also dedicated microfinance schemes operated by the Bank during the year. Total funds disbursed during the year under these categories amounts to LKR 287.3 million.

- National Agribusiness Development Programme (NADep) – 151 new facilities during the year

- Tharuna Diriya – 390 new facilities during the year

- Out Grower Farmers under 4P’s Module – 2,311 new facilities during the year

Special staff trainings were held in Central, North Central, North Western, Northern and Western Province North region during the year to enhance and expedite the appraisal of SME project lending.

Retail Advances

Housing Loans

Living in a home owned by oneself is the dream of many families whatever their social level and regardless of where they live. The Bank offers many housing loan schemes to cater to this aspiration at moderate interest rates and favourable repayment periods. The housing loans were promoted through Business Development Executives and a special outbound sales force, in addition to branch staff. Home loans can now be applied via online. It is possible for customers to have a loan application approved within 14 working days and two visits to the Bank. The Bank has special concessionary schemes for government employees and migrant workers overseas who maintain personal foreign currency accounts. BoC housing loan portfolio consists of many loan schemes such as Ran Niwasa, Siri Madura, Government Housing Loans, Special Housing Scheme for University Staff and Rehabilitation of Persons, Properties and Industries Authority (REPPIA). Also the Bank has made large contribution to Sonduru Piyasa, a loan scheme introduced under the guidance of Ministry of Finance to complete partly constructed houses below 1000 sq ft. BoC’s market share in this loan scheme is around 80%.

The home loan segment witnessed a significant growth of 17% during the year.

Personal Loans

Personal loans now account for 36% of the retail lending portfolio. Those can also now be applied via online. The personal loan facility is available for current or savings account holders who maintain a good banking relationship with the Bank. Personal loan process is simplified in terms of required documentation. Also we offer competitive pricing and BoC personal loans are available for various needs such as home improvement, college fees, wedding expenditure, a dream holiday, unexpected expenses and also to needs such as purchase of consumer durables.

Maintaining Asset Quality

With 52% of our retail assets comprising loans and receivables, its quality is very important for the Bank’s profitability and economic sustainability. With prudent credit appraisals and post-disbursement follow up, the Bank managed to improve its non-performing loans ratio to 3.1% as at 31 December 2017 as against 3.4% at end 2016 in the retail segment. During the year the economy performed below the expected level and the Bank had also to absorb the impacts of prolonged drought which prevailed in the northern part of the island have on the agricultural sector. However, the successful credit management policies adopted has made the Bank to improve its non-performing ratio in the retail segment.

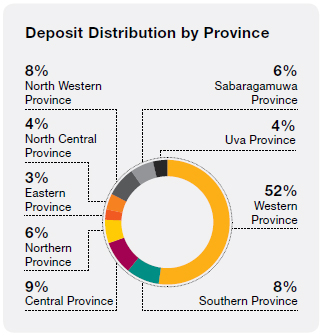

Deposits

Total deposits of the retail segment of the Bank at the end of 2017 crossed LKR 1.0 trillion mark compared to LKR 878.4 billion at the end of 2016. Our wide network of branches and our focus on bringing financial inclusion to those at the bottom of the social pyramid has enabled us to expand our deposit base. In addition our innovative concept of Branch-on-Wheels has enabled us to reach out to the most remote rural areas and to customers who do not have a conventional branch within convenient reach.

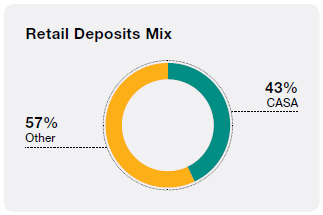

At the end of the year we had a somewhat low CASA ratio of 37%, across the Bank which was true industry-wide, due to the prevailing high interest rates. To counteract this, the Bank conducted special promotional campaigns to attract low cost funds, and the retail CASA ratio stood at 43%.

Special Account Mobilisation Campaigns

Several campaigns were conducted during the year, especially to mobilise accounts of senior citizens and minors. Some of them are described below:

- Promotional campaign for the Ran Kekulu minor account scheme for Grade 1 new entrance students drew an additional 46,939 accounts during the period of January to March 2017 with total deposits of LKR 243.7 million.

- Gifts were awarded for deposits made to a Ran Kekulu account on the banking day following the Sinhala and Tamil New Year. This helped to inculcate the savings habit among children as well as being in line with the “GanuDenu” tradition. The number of accounts opened was 80,946 with a value of LKR 289.5 million

- An “August Baby” campaign was conducted with incentives to coincide with the Bank’s 78th anniversary to encourage parents to open an account for every child born in the month of August 2017 by doubling the amount deposited to the account up to a maximum of LKR 1,000.0

- A similar campaign “Upadina Semata Ginumak” was also launched for all children born from 1 August to 31 December 2017. This campaign resulted in 263,757 new accounts with deposits of LKR 458.9 million.

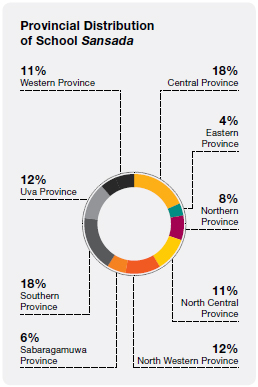

Also the 1,223 School Sansada and the 152 Mobile School units the Bank maintains at the schools all over the country not only expand our reach but in addition groom our next generation customers by inculcating the saving habit among them.

Corporate and Offshore Banking

The Bank’s corporate financing facilities cater to both the long-term financing and the working capital needs of the corporate sector. Long-term financing includes tailor-made packages which include both fixed investment costs as well as working capital needs. Competitive interest rates as well as flexible payment terms are offered. This includes both reducing balance and equated instalment interest plans.

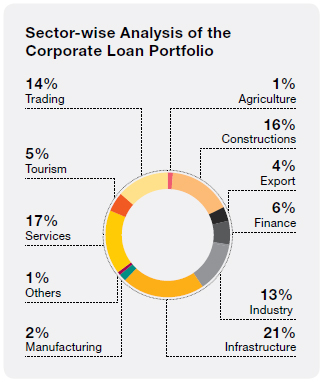

Corporate and offshore banking contributed 47% to the Bank’s loan portfolio in 2017 and 28% to the profit before tax. The Division assists the country’s overall economy through financing large corporate sector entities, projects and also to the direct Government and SOEs.

Support to Industrial Sector via corporate lending

The Bank also participates in syndicated projects in partnership with other banks which are too large for a single bank to finance. Syndicate projects for which the total financing was LKR 45.5 billion and the Bank of Ceylon share was LKR 7.3 billion were initiated during the year. Approximately 1,800 new jobs were created through new projects financed during the year.

Contribution of the Segment

The total exposure of the corporate segment at end of 2017 was LKR 572.0 billion. Of this, 44% was to the private sector while 56% was to the Government and State-Owned Enterprises. The corresponding percentages for 2016 were 51% and 49% respectively. However, the private sector exposure increased to LKR 245.8 billion from LKR 209.0 in 2016. This was achieved mainly through aggressive canvassing by Corporate Segment which drew 92 new customers. Going forward, the focus will be on utilising underutilised limits of existing customers to further increase private sector exposure.

Major Projects

One of the large scale projects financed was “Pearl Grand Tower Hotel” a five-star luxury city hotel with 420 rooms at a prominent city location in Colombo. The Bank also lent its support to two waste to energy projects via syndicate facilities, both public-private partnerships which demonstrated its commitment to green banking initiatives. One was the waste processing site at Karadiyana which is a joint-venture between Fairway Waste Management (Pvt) Limited and the Waste Management Authority (WMA) of the Government of Sri Lanka. The other is a similar project at Muthurajawela where Aitken Spence has joined hands with WMA.

However, the Bank continued its support to Government and State-Owned Enterprises by way of long-term finance for large infrastructure projects as well as financing short-term funding requirements. During the year, funds totalling LKR 17.0 billion has been disbursed towards financing water supply projects while a further sum of LKR 1.7 billion has been disbursed to finance road rehabilitation projects. In addition, the Bank has agreed to finance a sum of approximately LKR 10.0 billion towards infrastructure development projects to be initiated by the Ministry of Health.

Sector-wise Analysis

New Developments and Events

During the year, an automated system was introduced at Corporate Branch to recover documentation/processing charges pertaining to the credit facilities approved to corporate clients enhancing efficiency in collection process of the Bank.

Six customer felicitation events were carried out by the Corporate segment for the year 2017. Out of those, two events were carried out for top management of the corporate entities of Corporate Branch, Offshore Banking Division and Metropolitan Branch. Another three events were conducted by Corporate Branch, Metropolitan Branch and Offshore Banking Division respectively to recognise the support extended by the staff attached to direct dealing business units of corporate entities. In addition, an event was also conducted by Premiere Banking Centre to felicitate high net worth customers attached to their branch.

Future Plans

Plans are in pipeline to establish a special business unit to canvass high net worth customers/blue chip companies employing new and existing staff experienced in credit, trade finance and Forex transactions.

A new Project Financing Unit will also be established to handle large development projects including syndicated loans with a view to developing a specialised team of those who are competent in handling such projects in order to grab the potential business opportunities at early stages. In addition, the Unit will be equipped with competent staff to deal with financial reorganisation.

Further, initiatives are underway to provide an on-site technology platform to corporate clients which includes fully-fledged Internet and online banking solutions to cater their requirements.

In addition, arrangements are being made to introduce an automated workflow for inter-branch approvals for payments of corporate clients; another step to enhance the customer service.

Trade Finance Division

A wide portfolio of trade financing products is available to facilitate both imports and exports. The division also provides consultancy services to wide range of stakeholders including the Government, corporate clients, industry associations and the business community. The Trade Finance Division of the Bank continuously coordinates with the Export Development Board, Sri Lanka Export Credit Insurance Corporation (SLECIC) and the Ministry of Commerce to identify new exports/exporters and advise them on selection of export markets, banking procedure and documentation etc. During the year the division canvassed the Cinnamon and Pepper exporters and expanded the export clientele. Trade Services Division has also shared their knowledge with the Government agencies in trade policy formulation and planning, using their expertise in trade sector. We have a long history in this line of trade financing activities and have consistently maintained leadership in the segment. The Bank maintains high ethical standards and scrupulously comply with all rules and regulations. Our knowledge base that has been built up in this area gives us the highest negotiation capabilities and enables us to obtain the best possible terms for our clients. We are also able to leverage our long-standing relationships with our wide network of correspondent banks. The Bank also strengthen its relationships with clients through meetings and providing advisory services. The terms it provide to high net worth customers are extremely competitive.

This division has the distinction of holding and possessing the ISO 9001: 2008 certification which it received in 2011. The staff of the division receive comprehensive training, both local and overseas. BoC Trade Finance is also represented in the Trade Finance Association of Sri Lanka, Importers Association of Sri Lanka, Exporters Association of Sri Lanka, International Chamber of Commerce and National Chamber of Commerce which gives our staff exposure to the current international practices and also to address the issues of importers and exporters. During the year, two customer facilitation ceremonies were conducted.

Also during the last year, the division worked closely with the branch network to enhance technical competencies of the branch staff in trade finance through trade finance workshops. The focus was to canvass exporters of the SME category through branch network.

A wide portfolio of trade financing products is available to facilitate both imports and exports. The division also provides consultancy services to wide range of stakeholders including the Government, corporate clients, industry associations and the business community.

Performance in 2017

| Province |

2017 LKR billion |

2016 LKR billion |

Growth % |

| Import volume | 343.6 | 271.5 | 27 |

| Export Volume | 37.1 | 33.0 | 12 |

| Trade Finance income | 5.2 | 4.1 | 26 |

The Bank was awarded the “Leading Partner Bank of Sri Lanka for ADB” under its Trade Finance Programme in 2017 and in the history of Sri Lanka it is the first time that a Sri Lankan bank has been given this title.

Foreign Currency Banking Unit (FCBU) also forms an important part of the corporate segment and during the year process improvements were introduced to cater to customers more effectively. Corporate and the Offshore Banking Division helps the Government and its key SOEs to manage their funding requirements. Government treasury and the Ceylon Petroleum Corporation (CPC) are the main customers of the Division. It also plays a significant role in impairment management.

International, Treasury and Investment

These divisions handle the rupee and foreign currency funds, and thus play a critical role for the Bank. With a total deposit base of over LKR 1.5 trillion in the Bank, the largest for a financial institution, not only are the operations of these divisions crucial to the stability of the Bank, they are also important to the country’s economy. These divisions handle several key functions for the Bank, including investing the Bank’s funds, foreign exchange management, and asset and liability management. During the year under review, deposits increased by 23% while borrowings decreased by 11% compared with 2016.

Treasury Division

One of the largest operations of its kind, BoC Treasury has been a leader in the banking industry throughout its history, contributing significantly to the Bank’s overall profitability.

The Treasury comprises three main departments namely the Dealing Room, Primary Dealer Unit (PDU) and Asset and Liability Management Unit (ALM).The general functions of the Treasury Division encompass foreign exchange transactions, money market dealing, fund management, investments in Government securities, corporate sales, pricing of banking products, maintenance of mandatory reserve and liquidity ratios and management of assets and liabilities. Thereby Treasury Division contributes a significant portion to profitability.

It manages the Bank’s foreign exchange (FX) operations, ensuring that it has sufficient liquidity to meet obligations via managing the inflows and outflows of funds. The Treasury Division also plays a role in managing market risks by ensuring the optimal pricing of products, timely repricing and managing maturity mismatches in accordance with compliance requirements.

During the year, the Bank made significant investments in Treasury Bills, Sri Lanka Development Bonds, Debentures and Equities.

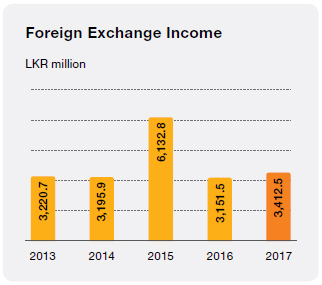

The year 2017 was an extremely successful year for the BoC Treasury. Achieving almost all of its goals, Treasury optimised on the opportunities emerging from the changes in exchange rate. As a result an impressive foreign exchange profit of LKR 3.4 billion was posted by December 2017. Some initiatives which were designed and implemented to expand the Treasury functions such as expanding the corporate desk, introducing a competitive pricing mechanism, aggressive foreign exchange trading, expanding relationships with exchange houses and system enhancement were all instrumental in achieving the better results.

New Technologies Adopted by Treasury Division during the Year and Resulting Benefits

Treasury is in the process of implementing a new system for asset and liability management of the Bank which facilitates the generation of required reports and will invariably enhance the decision-making function of the Bank. This system will go live in 2018 adding further impetus for accurate management of assets and liabilities.

Further, the Treasury Division has revised the treasury policy and ALM policy manuals to suit the latest changes in the market.

Movements in Policy Rates, AWFDR, AWPLR and AWDR, Exchange Rate and its Implications

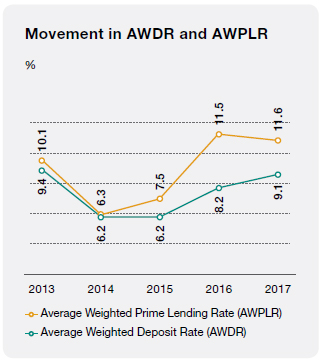

The Statutory Reserve Ratio (SRR) applicable to all rupee deposit liabilities of commercial banks was increased by 150 bsp to 7.5%, to be effective from the reserve week commencing 16 January 2016. On 24 March 2017, the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) were increased by 25 bsp to 7.25% and 8.75% respectively. Meanwhile, the commercial banks’ lending and deposit rates remained on a similar base as that of last year, with little changes observed. The Average Weighted Fixed Deposit Rate (AWFDR) at end 2017 increased to 11.48% from 10.46% last year, while the Average Weighted Prime Lending Rate (AWPLR) increased to 11.55% from 11.52% last year. The Monthly Average Weighted Deposit Rate (AWDR) increased to 9.07% from 8.17% last year.

The “YoY” growth of broad money continues to expand at 17.45% in December 2017, fuelled by credit expansion to both the private and public sectors by the banking sector. It was seen that credit granted to the private sector by commercial banks increased by 15.48% during the year. The growth in broad money supply has slowed down substantially in November 2017, caused mainly by the deceleration in the growth of private sector credit extended by commercial banks, responding to the tight monetary policy stance, as expected. Meanwhile, the yields on Government Securities have adjusted downward from the peak levels, correcting some disparity that existed between the policy rates and the yields on Government Securities. Other market interest rates are also expected to adjust further downwards in line with the yield rates.

Sri Lanka rupee depreciated against the United States Dollar by 2% over the year from LKR 149.85 in January to close at LKR 152.85 on 31 December 2017. It reached an all-time high during the month of July to stand at LKR 153.70.

In December 2017 Central Bank of Sri Lanka issued three guidelines which has an impact on Bank and Treasury operations:

- CIMM Reporting

- Foreign Currency Borrowings

- Derivative Guidelines

The Central Bank of Sri Lanka also pointed out that excess liquidity in the domestic money market continues to remain high. Operating within this environment of high liquidity, competition and upward inflation can be challenging. It is estimated that if this trend of high excess liquidity continues, it could lead to an undue expansion in monetary aggregates, fuelling future inflation in the economy. However, anticipating the negatives that may arise, the Bank intends expanding the REPO base, optimise fund management in Nostro accounts, increase relationship with customers who deal with trade finance and foreign exchange business, arrange foreign currency syndications and bilateral loans and issue more long-term debentures in order to maintain a healthy liquidity position.

Movement and Management of Government Securities

Being astute in our massive investment portfolio of over LKR 500 billion, the Banks investments were cautious yet incisive, having continuously analysed paradigms that are prevalent and emerging. In addition to investing in Government Securities, the Bank also divided its investments into Sri Lanka Development Bonds, Debentures and in Equities. Bank has invested USD 1.1 billion in Sri Lanka Development Bonds (SLDBs) as at end of 2017. A significant amount of funds invested in SLDB’s were own funds which the BoC received as inward remittances and export proceeds.

The Treasury Bill portfolio increased by 296% from LKR 28.8 billion last year to LKR 114.0 billion; the Treasury Bond portfolio decreased slightly to LKR 207.9 billion from LKR 220.1 billion in 2016.

With aggressive trading embarked upon in Treasury Bills, Bonds and Equity (adding trading of gilt-edged securities into the equation), the Treasury had a significant capital gain from Government Securities of LKR 456.7 million by the year end.

Contribution of Treasury Division to the Fund Management of the Bank

Treasury Division has steadily maintained the Liquidity Framework of the Bank by facilitating sufficient liquidity to face diverse stress events that are to be apprehended. Constant assessment of Liquidity Risk Management Framework and liquidity position is an important supervisory action that will ensure the proper functioning of the Bank.

The Treasury Division has had an eventful year contending with sustained low interest rates, balance sheet volatility, and a consistent flow of regulatory requirements. But amidst all these constraints Treasury Division has strengthened their liquidity buffers, implemented mandated ratios, and established the role of Treasury as a neutral steering function.

By adopting a new treasury operating model that gives a clearer mandate, centralised governance, and enhanced system and data capabilities, Treasury Division has improved Bank’s collateral, liquidity, and interest rate maturity transformation. With these changes and managing the proper balance between liquidity and profitability, Treasury Division assisted to boost net interest income (NII) of the Bank.

International Division

Remittances

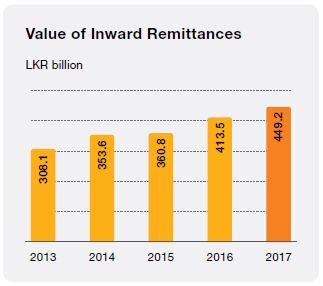

The Bank of Ceylon is the first Bank to venture into inward remittances to Sri Lanka and today we have a market share of 46%. Inward Remittance Department is linked with all branches to provide a smooth service to all our customers. Our network of over 800 correspondents worldwide facilitate the process, and we have over 600 locations where funds can be received. We have a variety of remittance systems and other facilities such as email/SMS notification to both sender and receiver. Customer inquiry desk were also strengthened with more staff. Through the international operations the Bank performs a socially beneficial function to the expatriate workers as well as making a major contribution to the economy of the country.

During the year “BoC Pita Pita Rata Thagi” campaign was launched and it offered 300 fabulous prizes to winners who receive inward remittances channelled through BoC. Three customer facilitation programmes were conducted in Tangalle, Bandaragama and Anuradapura. Also 112 awareness programmes were conducted in collaboration with Sri Lanka Bureau of Foreign Employment (SLBFE) targeting migrant workers.

The Bank also arranged awareness programmes and get-togethers for overseas exchange house/Bank staff and expatriate communities in South Korea, Qatar, UAE and Oman. Our highest performing markets in this segment are Qatar, South Korea and Italy.

The Bank also provides services for outward remittances and travel which are much availed by students and other travellers. Our Pay Office at the Bandaranaike International Airport functions on a 24-hour basis in both Arrival and Departure areas providing currency transaction and other services.

Correspondent Banking

BoC has correspondence relationships with 864 financial institutions around the world and one new exchange house was added during the year. Correspondent banks, which are financial institutions based overseas, facilitate wire transfers, conduct business transactions, accept deposits, and facilitate trade transactions on behalf of the customers of BoC.

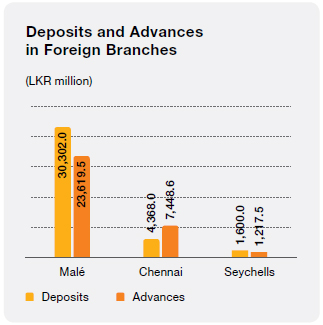

Overseas Operations

BoC’s current overseas operations are based in Malé, Chennai, Seychelles, and the subsidiary in the UK. The Bank has opportunities for further expansion overseas, especially in view of the fact that the nation has a large number of expatriate citizens across the globe. Expanding overseas operations is an attractive strategy for risk diversification.

Facing the Future

In its Corporate Plan for 2018-2020 greater focus has been given on “Service Care and Customer Tangibility”. The ultimate objective is to improve and standardise the customer experience across the entire network of customer touch points to a level where every customer is highly satisfied.

With the trends in customer preferences, digital banking will continue to be in the forefront of our strategy in 2018. “IT and Cyber Security” has also been identified as a focus area in the strategic plan. The technological infrastructure of the Bank needs to be updated to keep up with the demands of the millennial customers. While technology brings opportunities, it also brings threats. We have to ensure that our data, systems and networks are secured to the highest possible degree. Strategies have been developed to acquire the latest technological advancements to the Bank with the view of providing realistic total virtual banking experience to the customers. Going forward, the Bank will expand its Branch-on-Wheels mobile branch initiative to all provinces, and will open digital branches. Furthermore, we will continue automating business processes, and introduce new products over the course of the next year.

Under “Process Streamlining and Innovation” the Bank aims to look into the pain points and gaps within the existing products, processes and systems to revise and modify those where necessary to obtain maximum efficiency and effectiveness to enhance customer as well as employee satisfaction.

The Bank will also be focusing on expanding its border across the boundaries by establishing new business models, through looking at opportunities in innovative approaches. This will enhance its delivery channels to customers anywhere around the world and around the clock.

Parallel to this, the Bank will also give priority to “Credit Quality and Culture”, across all the customer segments: corporate, retail, SME and microfinancing. This will serve the dual purpose of providing customers with better service while improving the asset quality keeping in mind the more stringent requirements introduced by SLFRS 9.

Business Partners

The Bank regularly engages with third parties for the supply of goods and services, outsourced service providers, and correspondent banks. They are considered to be partners of the Bank, and the services they provide are essential to the Bank carrying out its business. During the year the Bank has carried out 556 numbers of procurements. Over 98% of these procurements are from local suppliers or agents and we always strive to maintain win-win situation in maintaining relationships with our business partners. Through building and maintaining long-term relationships based on trust with these business partners, the Bank ensures the steady supply of goods/services that meets a required standard, thereby enabling the Bank to conduct its business smoothly and without interruption. BoC being a State bank, procurements have to be conducted in a transparent manner, in accordance with laid down procedures. Calling for tenders for the procurement of goods and services is mandatory. The Bank’s procurements are based on Government procurement policy and hence it maintains transparency and also adheres to the minimum environmental and social standards set by the policy.

The Bank works with correspondent banks to facilitate transactions in foreign currencies and BoC owns the largest correspondent bank network in the country and we use this strength to provide our customers speedy and reliable trade finance and money transfer related services across the world.

Contribution to the Society/Corporate Social Responsibility

Sustainability is a cornerstone of the Bank’s strategy. We have identified pivotal areas of economic growth and the strategic CSR activities of the Bank are conducted under these areas; education, entrepreneurship development, preserving national heritage, ethics and values, livelihood development, social development and environmental conservation.

During the year a total of LKR 127.5 million has been distributed through its CSR budget as the contribution to the society under the above areas of strategic CSR. Distribution of the CSR fund under the strategic focus areas are:

- Preserving national heritage, ethics and values – LKR 28.3 million

- Entrepreneurship development – LKR 9.6 million

- Education – LKR 22.5 million

- Social development and environmental conservation – LKR 57.8 million

- Livelihood development – LKR 9.3 million

The Bank does not address these areas only through its CSR budget but also in their core business processes. The Bank uplifts the lives of many through its lending to microfinance and SME sectors, creating entrepreneurs.

Also the Bank distributes scholarships annually for Grade 5 and GCE A/L high fliers who are having Ran Kekulu accounts. Also Hapana programmes are conducted for Grade 5 students. These events also help in developing education of the students.

Preserving National Heritage, Ethics and Values

Annual donations to Sri Dalada Maligawa Perahara, Katharagama Esala Perahera, Gangarama temple, Nawam Mawatha Perahera, and the Annual Feast Celebration of the St. Jude’s Shrine, Indigolla and the sponsorship for the BoC Hindu Association by the Bank to celebrate Annual Navarathri Vizha.

Entrepreneurship Development

- Mithru microfinancing project

- A special microfinancing scheme carried out via bank funds to develop small entrepreneurs.

Education

The following were some of the socially beneficial educational activities which were conducted during the year under review.

- A total of 59 Hapana seminars were conducted for Grade 5 students and their parents during the year in both Sinhala and Tamil depending on the medium of instruction of students to coach them to face the Grade 5 scholarship programme. The number of students who were beneficiaries was 24,024, and the number of parents was 18,000.

- Ran Kakulu scholarships were awarded to high flying performers at the Grade 5 scholarship examinations. A total of 2000 scholarships of LKR 15,000 each were disbursed totalling LKR 30.0 million.

- Scholarships were awarded to account holders of 18 Plus accounts who have obtained high Z-scores at district level in each of the streams, at Advance Level Exams. The total amount disbursed under this programme was over LKR 6.0 million. The total number of students benefited was 198.

“Hapana” Scholarship distribution

- The Bank also sponsored an art competition titled “Punchi Picasso” jointly with the Ministry of Education with generous awards for prize winners. This competition drew an overwhelming response from all parts of the country. National and provincial level winners and also schools of the winners were benefited through cash prices and certificates.

Social Development and Environment Conservation

- Youth camp for environmental protection and prevention of drugs – Polonnaruwa.

- Sponsoring to athletic meets and sports events of various schools across the island.

- Sponsorships for stage dramas, musical events etc.

- Sponsoring to National Water Supply and Drainage Board to celebrate World Water Day.

Awarding prices for the “Punchi Picasso” Winners

Livelihood Development

- An art exhibition was also conducted for children at the “Apeksha” hospital children’s ward together with an entertainment event celebrating World Children’s day. This event brought some light into the lives of a group of children who do not have a normal childhood. Their art work is displayed in a dedicated area in the hospital.

Art exhibition held at “Apeksha” hospital children’s ward

- Guide to future seminar programme- develop financial discipline among students, soft skills development of the students, developing sense of responsibility among them, facilitate financial inclusion with the ultimate goal of developing a good citizen for the society. The seminars also covered how to use ATM, CDM, Internet banking facilities, mobile Banking, how to work with people, choices for career progression and employment and self-grooming via using Internet in proper manner – 171 seminars conducted islandwide, beneficiaries over 40,000 students.

- Sponsorships for Little Heart Programme.

Engagement

The following were the principal channels of engagement with stakeholders:

- Press advertisements, notices

- Notices on the website

- Official social media sites of the Bank

- Meetings with suppliers and service providers

- Bank’s outsourcing policy and other internal procedure documents

- Written communications with correspondent banks

Regulators

BoC is regulated by the Central Bank of Sri Lanka (CBSL) as a licensed commercial bank, and is subject to its directions, guidelines, and prudential regulations. Adhering to these guidelines and regulations ensures the safety and soundness of the Bank and the financial system. Penalties (financial and otherwise) can be imposed on the Bank in the event that it violates these regulations, and this can put the reputation of the Bank at risk.

Furthermore, the Bank is subject to directives and guidelines issued by other institutions, including the Inland Revenue Department, Colombo Stock Exchange, and the Credit Information Bureau.

The Bank primarily engages with these institutions through written correspondence and meetings and discussions. By working with these institutions, the Bank facilitates the smooth functioning of day-to-day operations and avoids exposure to reputational risk.

Guide for future seminar at Southern Province

Membership in Industry-Related Associations

The Bank has the membership in the following institutions and associations:

- Asia Pacific Rural and Agricultural Credit Association (APRACA)

- Association of Banking Sector Risk Professionals, Sri Lanka

- Institute of Bankers of Sri Lanka

- International Chamber of Commerce, Sri Lanka

- The National Chamber of Commerce, Sri Lanka

- Sri Lanka Banks Association (Guarantee) Limited

- Sri Lanka Law Library

- The Ceylon Chamber of Commerce

- The Financial Ombudsman of Sri Lanka (Guarantee) Limited

- Association of Compliance Officers of Banks, Sri Lanka

- Bar Association of Sri Lanka